Every company deals with expense reimbursement, and the process almost always feels like busy work. Employees procrastinate on filling out the forms, and the finance team has to spend time verifying data, processing claims, approving requests, and paying employees back. And that's not to mention the potential for end-of-the-year tax complications if employees don't get their expense reports in on time.

What is expense reimbursement and what are the types?

Expense reimbursement is the way businesses pay back their employees who have paid out of their own pockets for business-related expenses. Reimbursements for business travel, conferences, continuing education, and healthcare are among the most common requests for reimbursement.

Employees also sometimes pay for office equipment, a business meal, travel, or a training course to benefit the organization they serve. These business expenses are usually eligible for reimbursement. Since they’re not considered wages, reimbursements are non-taxable for employees. Some organizations also offer health reimbursement or Flexible Spending Accounts to reimburse their employees for money they spend on health premiums and qualified medical expenses.

Why you should automate and orchestrate your expense reimbursement process?

Nothing says human error like a manual process. When you rely on people to validate and approve claims, success hangs in the balance. Automation takes the headache out of the process. Here’s why finance teams should automate expense reimbursement:

Fast, compliant reimbursements

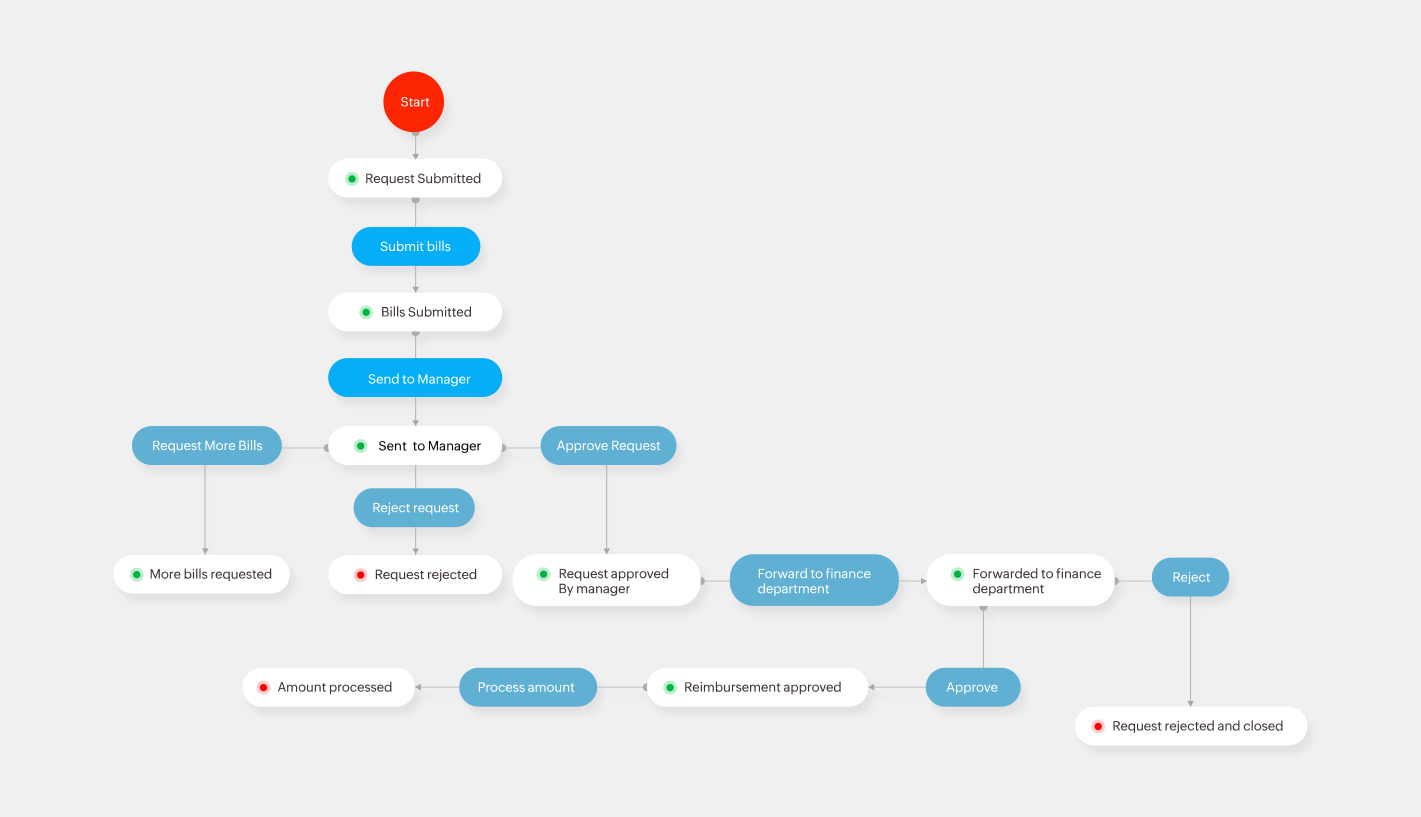

With automation, you can enforce compliance with company spending limit policies, and ensure that all requests go through the entire process before getting approved. By eliminating paper trails and documentation woes, most issues regarding the time-consuming nature of the process disappear.

Broader visibility

Does your finance team know how many requests are stuck, pending manager approval? Do they know how many still need to be processed along with this month’s payroll? With an automated process, you can track how much money goes out, and get a better picture of your cash flow.

Identifiable tax deductions and audits

Employee expenses must be qualified in order to stay on top of potential tax benefits. Clean records and audit trails demonstrate that your organization properly manages expenses and helps prevent miscalculations and fraud.

Happier employees

Submitting expenses and waiting for claims to be approved is tedious, manual work that's better left to automation. Employees will be happier that they can submit expense reports and claim reimbursements without the cumbersome paperwork, and finance professionals can spend their time on tasks that require more brain power and creativity.

What should an automated expense reimbursement process tool include?

Advanced expense reporting

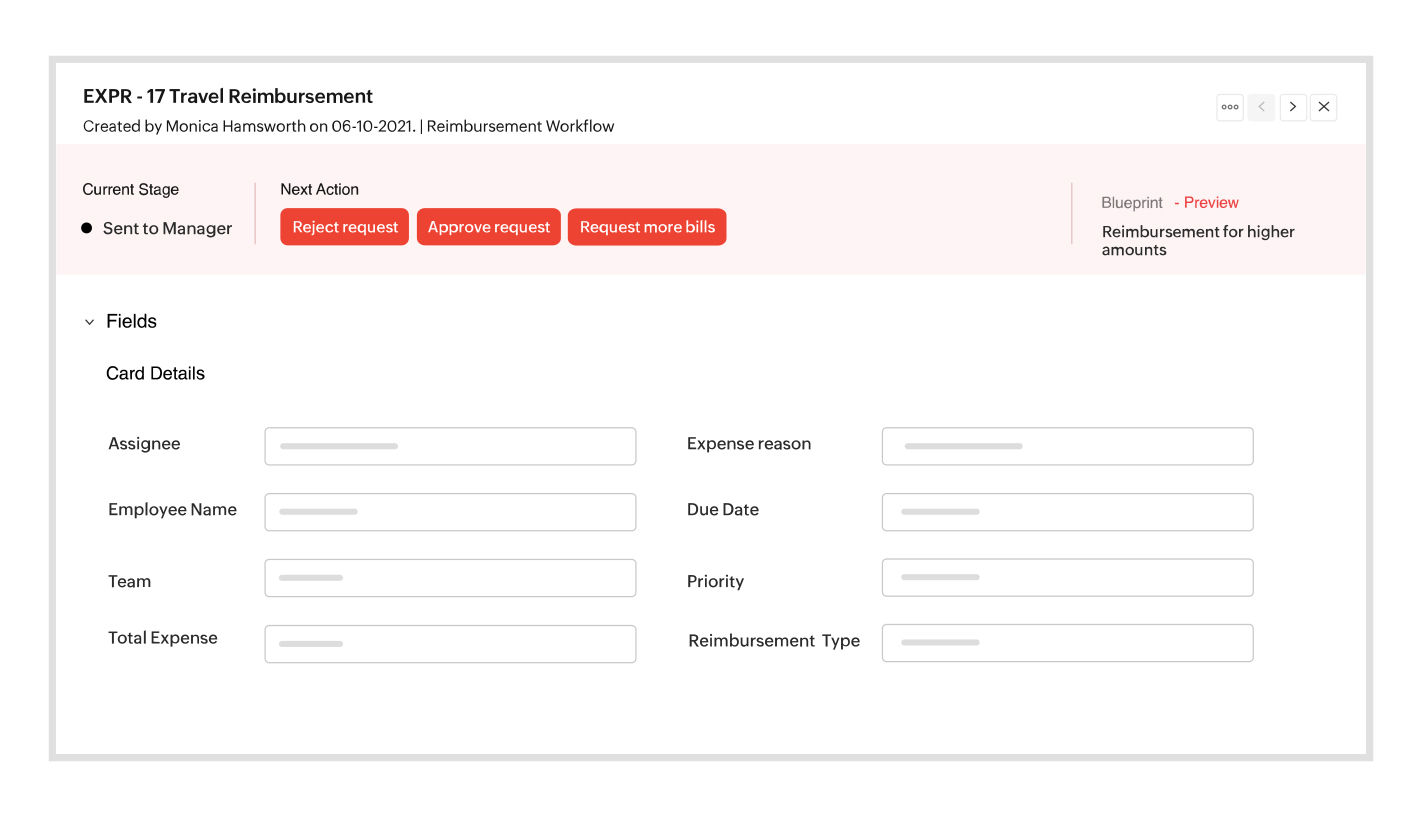

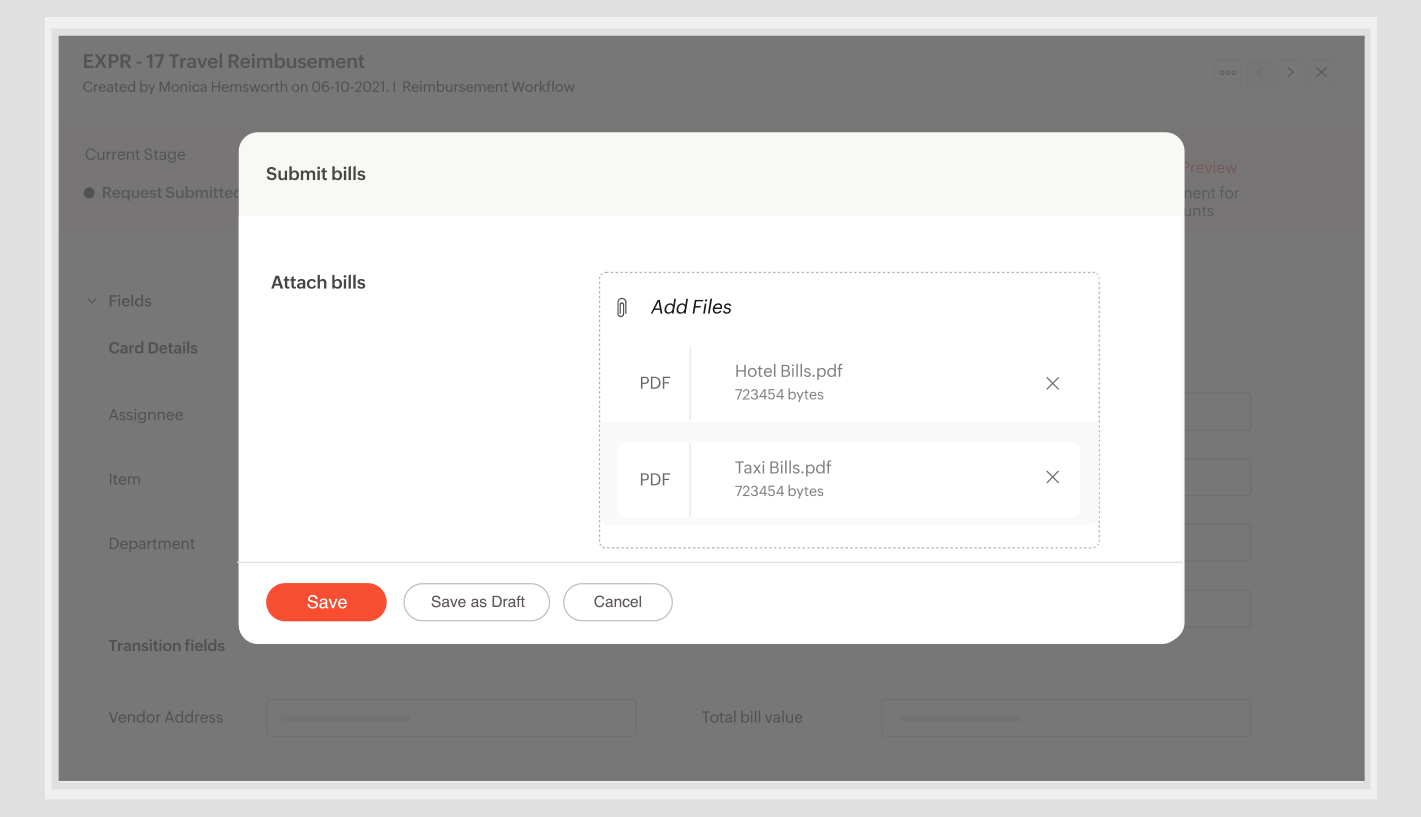

Employees should be able to submit expenses on the go, in real time.

Data validation

Whenever employees submit their reimbursement claims, the system should validate expenses and notify them if they aren’t adhering to spending guidelines. Features like auto-validation also prevent employees from submitting personal expenses. By only permitting the submission of requests that are accompanied by required documents and information, these platforms can eliminate unqualified requests right at the submission stage.

Expense approvals

Set auto-approval for requests that fall within pre-approved values, based on the requester's seniority.

Multicurrency entry

Allow entry in multiple currencies to accommodate requests from international travel.

Integrated system

For approved claims, the platform should post entries to accounts payable and to your payroll software, so employees can be reimbursed more easily. Integrate with your payroll to process reimbursements with employees’ monthly pay. And directly deposit the payout to the requester's bank account in cases like weekly mileage reimbursements.

So what are you waiting for? Streamline your organization’s expense reimbursement process today.