Transforming finance process through workflow automation: With use cases

The new age of finance efficiency

Finance teams today are not just bookkeepers—they're strategic partners, helping shape the direction of the business. But with growing responsibilities comes increased pressure: managing rising volumes of transactions, maintaining compliance across jurisdictions, and providing real-time insights for decision-making.

The traditional approach—relying on spreadsheets, emails, and disconnected tools—no longer holds up in a business environment that demands speed, accuracy, and agility. Finance leaders are recognizing that operational efficiency isn't just about cost-cutting anymore. It's about building resilience, improving governance, and gaining visibility into every dollar that moves through the organization.

Workflow automation is fast becoming the backbone of this transformation. By replacing repetitive manual processes with streamlined digital workflows, finance teams are freeing up time, minimizing errors, and focusing more on strategic initiatives. The result? Faster cycles, better compliance, and smarter decisions.

What slows down modern finance teams

Despite technological advances, many finance departments are still bogged down by outdated processes that hinder efficiency. Here's what continues to hold teams back:

Manual data entry and document handling: Relying on manual input introduces delays and increases the risk of human error in invoice processing, purchase order management, and expense tracking.

Disjointed systems: Financial data often resides in silos—across spreadsheets, shared drives, and various platforms—making it hard to get a consolidated view of operations or make informed decisions in real-time.

Email-based approvals and follow-ups: Without a structured workflow in place, teams rely on email threads to approve invoices, budgets, or purchase requests. This not only slows things down but also reduces visibility and accountability.

Compliance headaches: As finance teams deal with regulations like SOX, GDPR, or industry-specific standards, tracking approvals, maintaining audit trails, and proving compliance becomes a major challenge when processes are unstructured.

Lagging insights: Without real-time data dashboards, budget owners often rely on static reports, which offer little value in fast-changing environments. This delay can impact everything from spending decisions to quarterly forecasting.

These inefficiencies don't just waste time—they can hurt cash flow, delay vendor payments, and limit a company's ability to respond quickly to opportunities or risks.

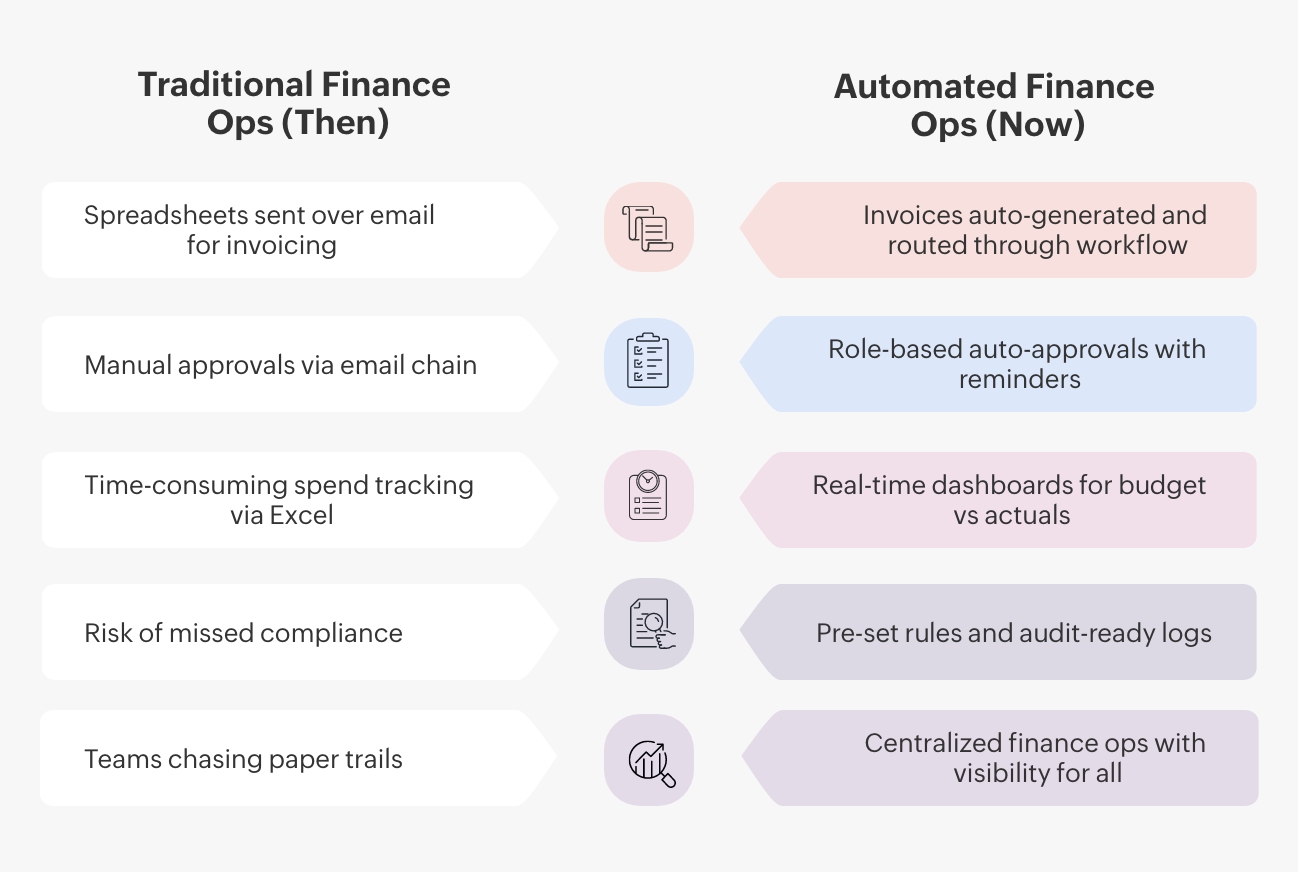

Finance operations then vs now: a look at the evolution

From spreadsheets to streamlined workflows: what's changed and why it matters

Finance has undergone a quiet revolution in the last decade, moving away from fragmented, manual-heavy workflows toward intelligent, automated systems that deliver clarity and control.

In the past, invoice approvals meant long email threads, with finance teams constantly following up. Spreadsheets circulated between departments for budget planning and tracking expenses meant digging through multiple Excel files. Compliance checks? They were often reactive and sometimes only triggered during audits.

Now, with automation tools, many of these processes are built into smart workflows that function in real-time:

Invoices are auto-routed for approval based on predefined roles and thresholds.

Expense reports are submitted through structured forms with automated validations.

Budgets are tracked via real-time dashboards linked to transactions.

Every action is logged, timestamped, and audit-ready.

This advancements aren't just about speed—it's about creating a more secure, transparent, and accountable finance operation. The more digital these workflows become, the more finance leaders can focus on forward-looking insights rather than chasing paper trails.

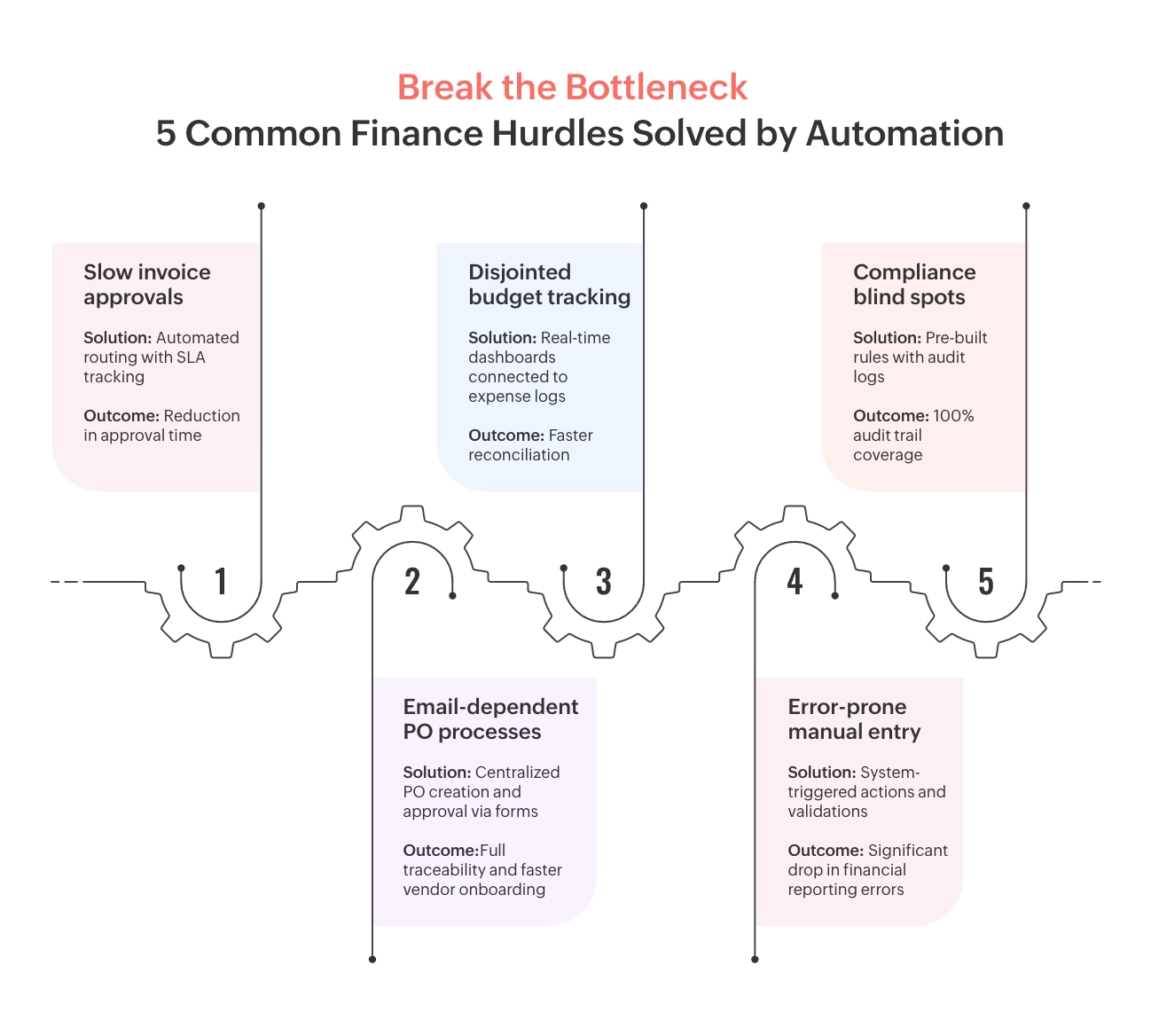

Common roadblocks in financial workflows (and how to fix them)

Finance teams often encounter recurring friction points that slow down operations and introduce risk. These bottlenecks may appear small in isolation, but collectively they consume valuable time and reduce process visibility.

Let's look at some of the most common hurdles—and how workflow automation addresses each:

Slow invoice approvals

Bottleneck: Invoices pile up in inboxes, waiting for approvals from multiple stakeholders.

Fix: Automated routing with SLA tracking ensures the right people review documents on time, with automated reminders and escalation paths to avoid bottlenecks.

Disjointed budget tracking

Bottleneck: Budget owners often operate in silos, leading to inconsistent or delayed tracking.

Fix: Real-time dashboards connected to approved expenditures and actuals allow for immediate visibility, aiding faster, more accurate forecasting.

Email-dependent purchase order (PO) processes

Bottleneck: Relying on emails to create, request, and approve POs increases turnaround time and reduces accountability.

Fix: Structured digital forms and rule-based approval paths help centralize POs, improve auditability, and speed up vendor onboarding.

Compliance blind spots

Bottleneck: Lack of documentation, audit logs, or defined rules make regulatory audits stressful and time-consuming.

Fix: Automated workflows include audit-ready logs, predefined compliance rules, and permission controls that ensure transparency and security.

Error-prone manual entry

Bottleneck: Finance staff inputting data manually increases the likelihood of mistakes in financial reports and statements.

Fix: System-triggered actions, validations, and integrations reduce manual touchpoints and improve data accuracy across processes.

These automation strategies not only eliminate inefficiencies but also elevate the role of finance teams by reducing busywork and improving strategic impact.

The benefits of automating finance processes

Adopting workflow automation in finance doesn't just reduce processing times—it fundamentally changes how teams work. The benefits go far beyond eliminating paperwork:

Improved accuracy

Automated data validations and structured workflows reduce the potential for human error in tasks like invoice processing or financial reporting.

Increased transparency

Every action in a workflow is recorded, making it easier to trace who did what and when. This clarity supports better decision-making and reduces the risk of fraud or miscommunication.

Faster cycle times

Whether it's processing expense reimbursements, approving purchase requests, or closing the books, automated workflows move faster—and with fewer handoffs.

Stronger compliance

Built-in rules, audit trails, and access controls make it easier to meet regulatory requirements and prove compliance during audits.

Better resource allocation

With repetitive tasks offloaded to systems, finance teams can shift focus to more strategic responsibilities like budgeting, forecasting, and performance analysis.

These outcomes collectively drive agility, enabling businesses to respond more confidently to market shifts, cost pressures, and growth opportunities.

Choosing the right automation platform for finance

Not every automation tool is suited for finance operations. Finance teams need platforms that offer a fine balance between flexibility, control, and security. When selecting a workflow automation platform for financial processes, consider the following:

Customizable workflows

Can the platform adapt to your unique approval hierarchies, business rules, and exceptions? Finance processes are rarely one-size-fits-all.

Role-based access control

Sensitive financial data must be protected. Ensure the platform supports granular permissions, audit trails, and robust user management.

Integration capabilities

A good platform should work seamlessly with your existing tools—ERP systems, accounting software, HR platforms—to create an uninterrupted flow of data.

Dashboard and analytics

Real-time insights into spend, cycle times, and approvals help track performance and spot inefficiencies early.

Compliance and audit support

Ensure the platform keeps an immutable record of activities, supports documentation uploads, and can generate reports needed for audits.

Workflow automation platforms like Qntrl are designed to meet these needs head-on. With its intuitive design, flexible process builder, and secure automation engine, Qntrl enables finance teams to transform how they manage requests, approvals, tracking, and compliance—all without writing a line of code.

How Qntrl simplifies finance operations

Qntrl is built to give finance teams full control over their workflows—from standardizing processes to enforcing compliance and surfacing insights. Whether you're managing vendor onboarding, expense approvals, or month-end closing tasks, Qntrl ensures every step is structured, trackable, and automated.

Here's how Qntrl empowers finance operations

Visual workflow builder

Drag-and-drop your finance workflows—like invoice approvals, PO management, or travel reimbursements—without writing code. Customize stages, approvals, and conditions with precision.

Centralized request management

Bring all finance-related requests into one organized system. No more scattered email threads or missed updates. With forms and role-based routing, each request reaches the right team at the right time.

Audit-ready compliance

Every transaction in Qntrl is logged. Whether you need to trace back approval trails or prepare for financial audits, Qntrl's logs and document attachments ensure you're always prepared.

Real-time insights

Monitor workflow status, approval bottlenecks, and cycle times via dashboards. Finance teams gain immediate visibility into where things stand—enabling quicker responses and smarter planning.

Built-in governance

Define rules, policies, and user permissions to ensure secure access, minimize risk, and maintain compliance across your financial operations.

With Qntrl, your finance team gets more than just automation—they gain a robust governance layer that aligns people, processes, and controls in one unified platform.

Tailored solutions for financial process automation

Qntrl offers specialized workflows designed to streamline various financial operations, enhancing efficiency and compliance. Key use cases include:

Accounts payable automation: Digitize invoice processing with automated approvals and real-time tracking, reducing manual errors and ensuring timely payments.

Accounts receivable management: Automate invoicing and payment reminders to improve cash flow predictability and reduce days sales outstanding (DSO).

Expense reimbursement workflows: Simplify employee reimbursements with customizable forms and approval hierarchies, ensuring policy compliance and faster processing.

Budget approval processes: Facilitate structured budget planning and approvals, providing transparency and control over financial allocations.

By implementing these workflows, organizations can achieve greater visibility, reduce processing times, and maintain compliance across financial operations.

Getting started with finance automation in Qntrl

Transitioning from manual to automated processes might sound complex, but Qntrl is designed to be business-user-friendly. Getting started is fast and straightforward:

Pick a priority process: Choose a high-volume, high-impact workflow, such as expense reimbursements or invoice approvals, as your starting point.

Map your workflow visually: Use Qntrl's intuitive workflow designer to lay out stages, conditions, and stakeholders. With just a few clicks, define rules and actions.

Add forms and permissions: Build a custom form to capture information at the start of the workflow. Set access levels and routing logic to enforce controls.

Go live and iterate: Test your workflow, deploy it to your team, and use real-time feedback and insights to refine it. Qntrl makes optimization continuous and effortless.

This low-barrier entry lets finance teams begin small, prove ROI fast, and scale across additional use cases—from vendor management to capital expenditure requests.

Finance agility starts with process control

Financial operations sit at the core of every business. When those processes are slow, inconsistent, or error-prone, the entire organization feels the impact. But when they're automated, governed, and optimized, finance becomes a true enabler of growth and innovation.

From reducing approval delays to enhancing compliance and surfacing real-time insights, finance process automation gives the team back control so they can focus less on paperwork and more on strategic finance.

Qntrl helps finance leaders take the first step toward that transformation. With its no-code workflow engine, built-in governance, and deep visibility, Qntrl makes finance automation not only possible—but practical.

Ready to put your finance operations on autopilot?

Schedule a free Qntrl demo today and see how easy it is to streamline and secure your financial workflows.

Enjoying your reading?

Enjoy organization and visibility too!

Qntrl can help you organise, control and improve production and projects in your team.